What will change as interest rates rise is the amount of the monthly annuity that is the actuarial equivalent of the cash balance account payable in a lump sum. Notably, this issue does not typically arise with cash balance plans with a lump sum distribution option, because the lump sum is generally the participant’s account balance, which is not sensitive to the applicable interest rate. There are a number of strategies that plan sponsors can use to reduce the likelihood of staffing crises, including offering an in-service distribution option under the pension plan for older employees who meet specified age and service requirements, or offering targeted cash retention bonuses to partially or fully offset the reduction in lump sum distributions. Plan sponsors who believe they may be in this position should begin planning now, especially with regard to staffing concerns. Even more significantly, a large increase in retirements or other employment terminations at year-end may result in staffing challenges.

90000 LUMP SUM 7 YEARS FROM NOW CODE

If the plan’s funding level drops below 80%, Code Section 436 may restrict or prohibit the plan from paying lump sums. If the plan is less than 100% funded, lump sum payments will cause the plan’s funded status to decline further. This will result in increased liquidity needs for the plan in order to fund the distributions, and may also give rise to an accounting charge for a settlement, which can occur when lump sum distributions for a given year exceed a threshold. Likewise, active employees may choose to terminate employment in order to receive a larger lump sum distribution before the rate increase takes effect. Specifically, a lump sum distribution taken at the end of 2022 may be in the range of 25% higher than a lump sum distribution of the same benefit taken in early 2023.Īs a consequence, deferred vested participants who are eligible to elect a lump sum distribution may decide to do so before the plan’s applicable interest rate rises. In some cases, the decrease may be significant.įor example, if a plan updates the applicable interest rate at the end of each calendar year, the applicable interest rate for lump sum distributions taken in 2023 is likely to be much higher than the applicable interest rate for distributions taken in 2022. With interest rates increasing rapidly, upcoming changes to the applicable interest rate may cause lump sum payments to decrease.

90000 LUMP SUM 7 YEARS FROM NOW UPDATE

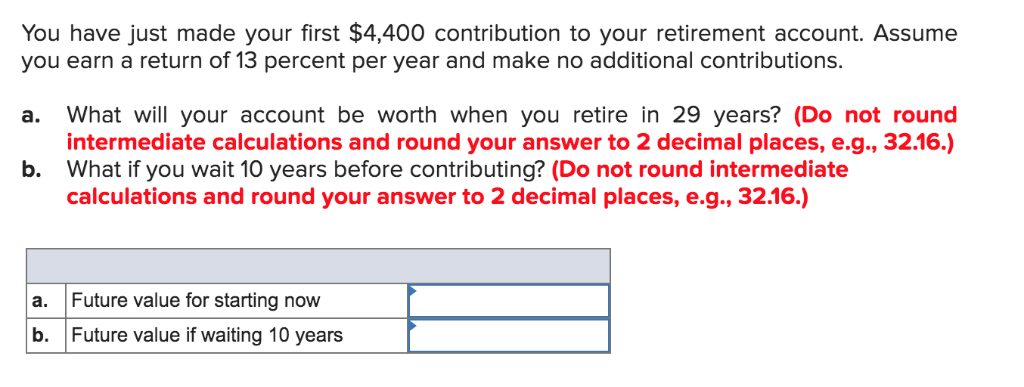

Plans must update the applicable interest rate on a monthly, quarterly, or annual basis. Higher interest rates result in smaller lump sums, and lower rates result in larger lump sums. The amount of the lump sum distribution is sensitive to the applicable interest rate (calculated under Internal Revenue Code Section 417(e)) and varies inversely with the rate level. Future Value (FV) the calculated future value of our investment FVIF Future Value Interest Factor that accounts for your input Number of Periods, Interest Rate and Compounding Frequency and can now be applied to other present value amounts to find the future value under the same conditions.Many traditional defined benefit plans, such as final average pay plans, offer a lump sum distribution as an optional form of benefit. Total Number of Periods (n) n = mt is the total number of compounding periods for the life of the investment.

Interest Rate (i) i = (r/m) interest rate per compounding period. Continuous Compounding is when the frequency of compounding (m) is increased up to infinity. If a period is a year then annually=1, quarterly=4, monthly=12, daily = 365, etc. Compounding (m) is the number of times compounding occurs per period.

Enter whole numbers or use decimals for partial periods such as months for example, 7.5 years is 7 yr 6 mo.

r = R/100, the interest rate in decimal Number of Periods (t) commonly this will be number of years but periods can be any time unit. Interest Rate (R) is the annual nominal interest rate or "stated rate" in percent. Investment (PV) is the present value or principal amount to be invested. Period commonly a period will be a year but it can be any time interval you want as long as all inputs are consistent. Calculate the future value return for a present value lump sum investment, or a one time investment, based on a constant interest rate per period and compounding.

0 kommentar(er)

0 kommentar(er)